Winning the shoe game: Understanding and leveraging current consumer trends & motivations

Footwear trends have continued to evolve as briskly as ever in recent times, both during and since the pandemic, as consumers have adopted important new patterns of consumption and behavior. For example, the athleisure trend continues to rise; we’ve seen a nod to nostalgia as Gen Z has resurrected Doc Martens; and Birkenstock clogs seem to have replaced Ugg slippers as the “it” shoe. So, what consumer trends are happening right now? What factors and motivations are driving them? And what can footwear brands and retailers do to win in today’s environment?

From barefoot to Birkenstocks to back-to-office

During the pandemic, shoe standards evolved significantly as many consumers worked from home, often barefoot or in Birkenstocks. Now, as employees at 9 in 10 companies are being required to return to the office for at least part of the week, some consumers are dusting off their pre-pandemic dress shoes and high heels, while others have permanently given them the boot as dress codes in many organizations may remain permanently relaxed compared to pre-pandemic levels.

Online shopping is up – and will keep growing – but in-store shopping still reigns

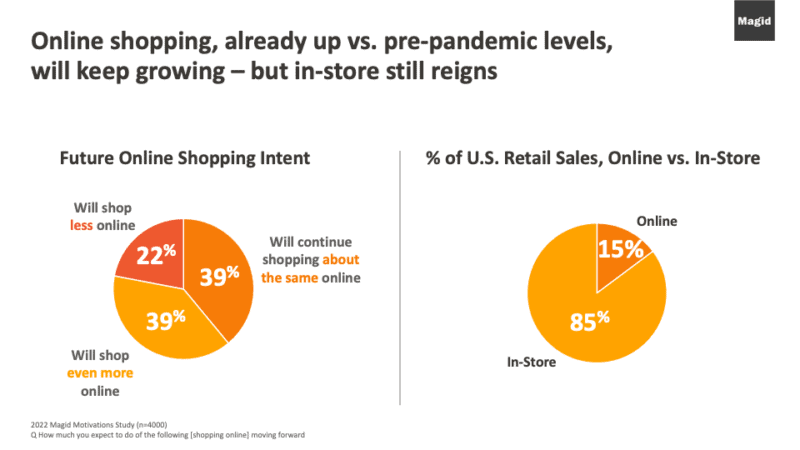

Unsurprisingly, online shopping was up across virtually all product categories, including footwear, during the pandemic. Moreover, results from Magid’s recent Consumer Motivations Study show that we’re still seeing higher levels of online shopping compared to pre-pandemic – and that consumers plan to continue shopping online at today’s elevated level, or even higher.

Specifically, 39% of consumers say they plan continue to shop online at about the same elevated rate as today going forward, and another 39% say they plan to shop online at an even higher rate, while only 22% say they plan to go back to their old ways and shop online less frequently.

Importantly, however, despite the growth of online shopping, in-store shopping is still dominant. Specifically, according to Statista, the share of e-commerce in total U.S. retail sales stood at 14.8% (Q3 2022) – meaning in-store still accounts for about 85% of overall revenues.

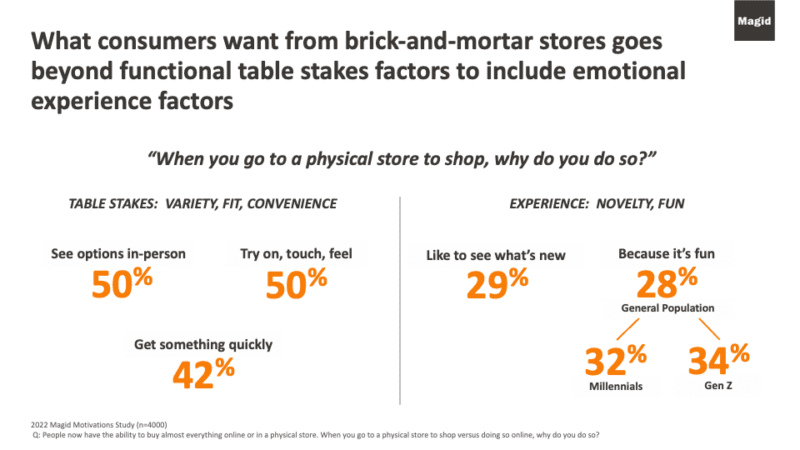

Why are consumers still so interested in in-store shopping? Magid’s research shows fully half of consumers want to see options in person, so they can touch them, feel them, and try them on. Meanwhile, there’s also the convenience factor – even with many retailers offering two-day shipping – of getting what they need right away.

Beyond these functional “table stakes” factors, consumers also identified certain emotionally-resonant factors, such as the novelty of seeing what’s new up-close-and-personal, and the sheer fun of shopping in-person (whether solo, or with friends as a social occasion), which was an especially powerful motivators amog the key Millennial and Gen Z segments.

So, how can you win in today’s environment?

There are a million possibilities, of course – but here are two example approaches we’ve been impressed by recently:

Example 1: Create Powerful Collaborations. Check out how Red Wing Shoes is using collaboration to amplify causes that align with their brand, via their collaboration with young artists via Juxtaposition Arts, or how Nike is using collaboration to borrow brand equity from luxury brands, via their recently-announced Nike + Tiffany & Co. initiative.

Example 2: Create an Elevated In-Store Experience. Check out what Nike – a brand much-loved by Gen Z – has done with the opening of its Nike Aventura store in Miami, which features Sport Pulse, a digital storytelling platform with local sports content, as well as a Nike By You space where can customers can customize their sneakers and apparel for purchase.

The bottom line

Winning in today’s footwear environment isn’t about either/or, it’s about both/and. It’s critical for brands and retailers to know their particular target customers’ current preferences and motivations inside out, in order to deliver an outstanding, well-integrated product/shopping experience, both online and in-store, to meet both consumers’ functional and emotional needs.

Ask yourself: Do you have a fully-current, in-depth understanding of what’s going on inside the heads of your particular target customers? If so, well done! If not, Magid’s unique marketing research and consulting advice might be worth trying on for size.