Another Amazon disruption: the private label mattress market

Amazon wants to bring you a good night’s sleep and deliver it to your home in two days. Amazon currently sells mattresses from Purple, Ashley and others, but is now taking the step of offering its own branded mattresses via the AmazonBasics line. The offering includes foam mattresses ranging from as low as $129.99 for an 8-inch twin to $349.99 for a 12-inch king.

Low priced entry

With private label growing throughout retail and many jumping into the “bed in a box” craze, it’s not surprising to see Amazon join the party. What is surprising is the aggressively low price points.

A quick check of offerings within the king-sized mattress space (looking at 12” thick foam models) demonstrates that only Wayfair (with its own private label offering) and Walmart beat out Amazon’s $349 offering. Nectar, Casper, Leesa, and Purple are all far more expensive.

King size foam mattress pricing of 12 inch models as of Oct. 1, 2018

- Wayfair – Wayfair Sleep – $281

- Walmart – Spa Sensations by Zinus – $314

- AmazonBasics – $349

- Mattress Firm – Eclipse Deluxe – $559

- Nectar – $799

- Casper – $1,195

- Leesa – $1,195

- Purple – $1,299

Mattress experts will be quick to point out there’s a world of difference in quality between these offerings, but the fact that Amazon came in so low with its initial offering undoubtedly puts pressure on competitors to react.

Private label opportunity?

Seeing Amazon aggressively jump into the private label mattress market has many questioning if customers will opt for store brands given the historic strength of brands like Serta, Sealy and Simmons.

Magid has measured customer interest in private label, by category, revealing a high level of interest for private label brands in furniture and mattresses. 62% of customers indicated they were open to purchasing private label brands within the category. Additionally, the adjacent categories of home décor and home improvement produced similarly strong scores.

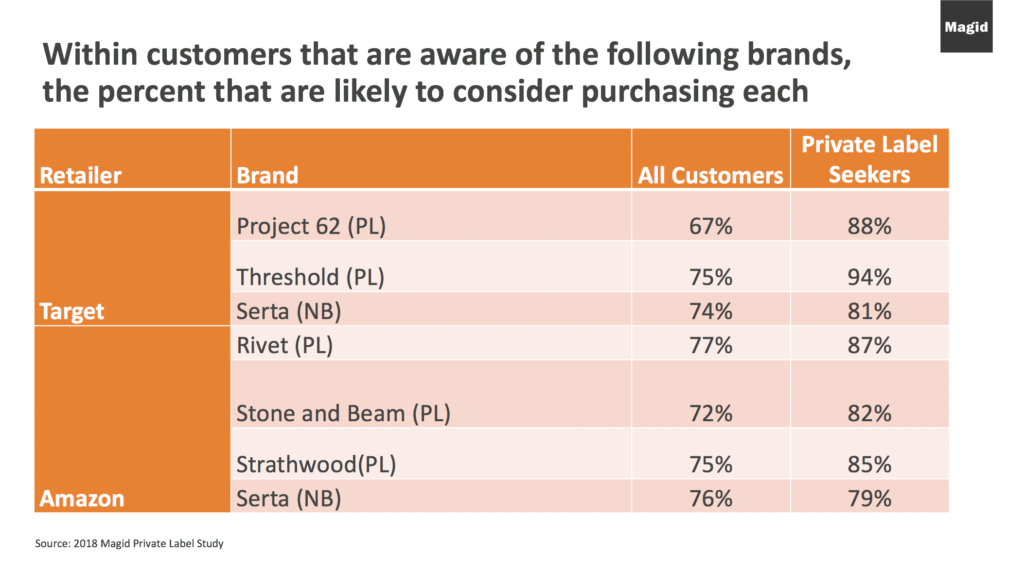

Looking at how customers responded to specific brands within Target and Amazon revealed even greater understanding as to how open customers are to private label within furniture and mattresses.

We asked these customers about private label brands (PL) and national brands (NB) without prompting them whether each brand was private label or national. We simply asked if they were aware of the brands, and if they would consider purchasing them. The awareness of the private label brands was unsurprisingly lower, but customers aware of the private label brands were just as open to them as national brands. This finding was amplified when we drilled into private label seekers (those that identified themselves as being open to private label within the category) with these people being more open to private label brands such as Target’s Threshold and Amazon’s Rivet brands when compared to the national brand of Serta.

While Target’s Threshold and Amazon’s Rivet are not currently targeting the mattress category, the simple interest in these brands within these private label “seekers” is likely one of the key factors that drove Amazon’s desire to jump into the private label space. This same finding also represents great opportunity for furniture retailers seeking to differentiate themselves in an increasingly competitive market.

Private label “seekers”

Magid’s research determined that 62% of consumers label themselves as “very” or “extremely” open to buying private label furniture and mattresses. These private label “seekers” are the customers that Amazon is going after with this new product offering. What makes these customers different? Seven key attributes listed below differentiate “seekers” from the general population.

- Gender bias to men

- Higher income

- Younger

- Fall within the “Status Sensitive” Persona Segmentation

- More urban

- Kids in the house

How should traditional furniture players respond?

The one ace in the hole for traditional furniture retailers is that physical presence is still vitally important—particularly within a category that is evolving with the advent of newer technologies like memory foam.

Magid’s advice to traditional retailers is to engage in private label by understanding who the “seekers” are and how they interact with your brand, and combining this with the desire for physical engagement with the product.

Taking these two steps will allow traditional retailers the ability to stay relevant in this highly dynamic market.