One Day at a Time cancellation sheds new light on SVOD model

From highlighting challenges in measurement and syndication practices, to showing the intensifying interest in vertical integration, and cultivation of better representation (perfectly illustrated via tweet below), and more, the recent news about One Day at a Time’s cancellation (and the subsequent campaign to find the show a linear home) has illustrated just how the SVOD model is changing the TV landscape.

With a Rotten Tomatoes score of 98% across all critics and an average audience score of 91%, many initially assumed the show must have suffered from low viewership. A few pieces have debunked that belief to a certain extent, or at least pointed to a complex web of reasons behind the move. There’s potentially no better piece than ‘Feeling the Churn: Why Netflix Cancels Shows After a Couple of Seasons’ from Deadline Hollywood (late last year, we offered insights on addressing churn in our piece on the dip-in subscriber segment).

Comparing apples to oranges

Last May, Brooklyn Nine-Nine co-creator and showrunner Dan Goor was asked about Nielsen ratings in the wake of his series’ 31-hour-cancelled-to-renewed-on-a-new-net saga. Goor seemed to empathize with Fox’s predicament given the show’s unreported Hulu numbers [where he speculates the show had done well] were irrelevant to their business decisions.

While Nielsen has rigorous ratings methodologies in play, we’ve developed a directional tool using our EmotionalDNA® offering to address the measurement enigma: linear TV relies heavily on live and time-shifted viewing (this pins much of the total viewing to particular moments in time), whereas Netflix (and other SVOD) originals are consumed as the viewer chooses (perhaps over a longer period of time or binged intensively).

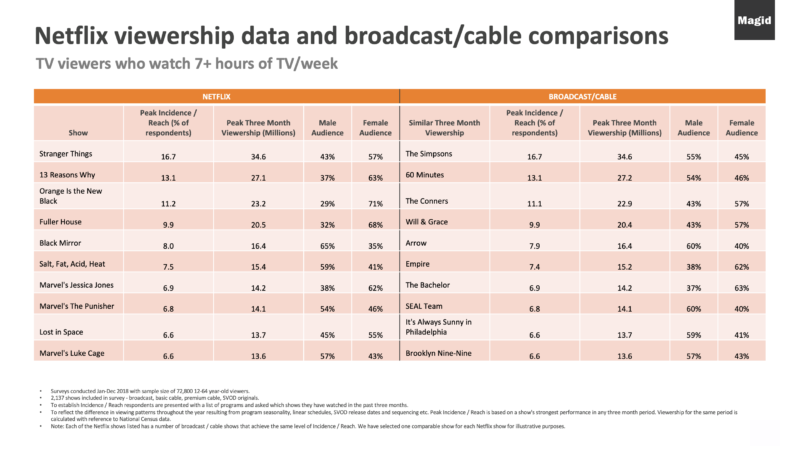

To gain a meaningful comparison using our own proprietary dataset, we look at audience size over the past twelve months and then identify the audience reach or “Incidence” in the population of 12-64-year-olds that have watched the show in the strongest three-month period, for each show, to give the best comparable indication of relative performance. While this is not a comprehensive analysis of the total audience, the approach enables us to come much closer to assessing viewing in a way that is more directly comparable and useful to our clients.

It’s important to note that our analysis is based on the longer tail of viewing, not overnight viewing. This of course benefits the linear shows available on multiple platforms in the long run and is a more holistic look at viewership.

The chart below takes the top Netflix shows according to our dataset, and provides one comparable broadcast or cable program that is illustrative of how that linear program performs in this viewership model for the whole of 2018.

The way we’ve collected this data does leave off some linear rock stars, including Game of Thrones, which rates at 11.7 Peak Incidence and 24.2 million viewers in 2018 according to the parameters outlined. This is absolutely phenomenal given no new episodes were released last year, and again illustrates why this type of measurement is distinctly unique and significant.

ODAAT decision shows the linear side of SVOD

Linear television executives have often danced around cost as a mitigating factor, and now it’s Netflix’s turn. My colleague Annie Ludtke found ODAAT had a higher peak viewership using the methodology outlined above than other Netflix comedies renewed for future seasons. Given the previous mention of vertical integration, we looked at how ODAAT may be different from its renewed peers Atypical, F is for Family and Dear White People. While none of the four are entirely produced by the SVOD, clearly each has its own unique contract, cost model and clauses that would make it attractive – or not, just as in linear.

Annie also found ODAAT’s peak three-month Incidence in 2018 was 3.3% of weekly TV viewers, which is on par with the reach of competitor Amazon’s award-darling, The Marvelous Mrs. Maisel. Amazon was more enthusiastic in getting the series to season three (greenlighting an early renewal before its second season premiered) than Netflix was with ODAAT which only got to a third season after show producers and talent rallied the fanbase. Awards seem to be part of the equation in SVOD just as in linear, and despite being critically acclaimed, ODAAT often came up short.

As the industry continues to speculate about the future of ODAAT, more questions will arise about how linear, SVOD, AVOD, and those trying to play in multiple spaces will model and operate. The three-or-four season program is likely just the beginning.

Interested in learning more about our EmotionalDNA solution? Let’s talk!

UPDATE: As of June 27th, 2019, Pop TV announced that it will pick up One Day at a Time with the fourth season to air in 2020. Pop TV has been pursuing the series since April 2019.