Online grocery shopping in 2023: 3 strategies for success

Now that the world has begun to stabilize post-pandemic, it’s become clear that predictions of a radical and immediate shift to online grocery shopping were overstated. Nor are we going back to how things were pre-pandemic.

According to The Mercatus Center, e-commerce sales are forecast to account for 9.5% of total U.S. grocery sales this year, up from 3.4% in 2019.

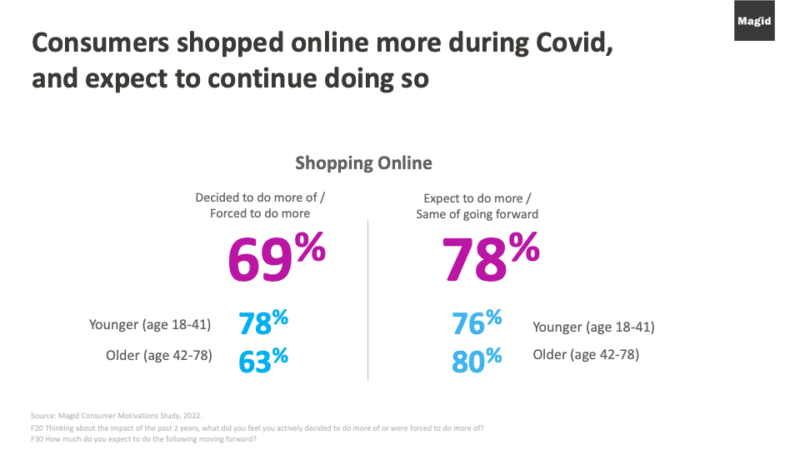

That growth follows a strong trend in online shopping overall. According to Magid’s Consumer Motivations study of 4,000 consumers (ages 18-76 matched to U.S. census) 69% of all shoppers did more online shopping during the past two years, and 78% expect to continue to do so going forward.

Those consumer expectations are backed up by actual buying behavior. Coresight’s “U.S. Online Grocery Survey 2022” report found 54.3% of U.S. adults had purchased groceries online in the past 12 months, well above the 36.9% in 2019, but down from 59% in 2021.

Even as health and safety concerns have waned, many consumers still enjoy the convenience and flexibility of online grocery shopping. For others, online grocery shopping through the pandemic was hugely disappointing due to the experience itself and/or supply chain issues.

In essence, the pandemic created a trial period for online shopping, with the familiar mix of adoption, loyalty and drop-off. There’s clearly enough of a market – and growth – to pay attention, and now grocery retailers and CPG manufacturers must stay ahead of the curve as attitudes and behaviors evolve.

Here are three strategies that need to be part of any plan forward.

- Optimize for omni-channel

While many consider grocery shopping as an either/or proposition (physical store/online), the fact is, for most shoppers, it’s both. In most cases, a shopper chooses which to use based on the type of products (e.g., canned goods versus fresh produce), trip mission (pantry load versus fill in), or other factors (weather, gas prices, other errands, etc.).

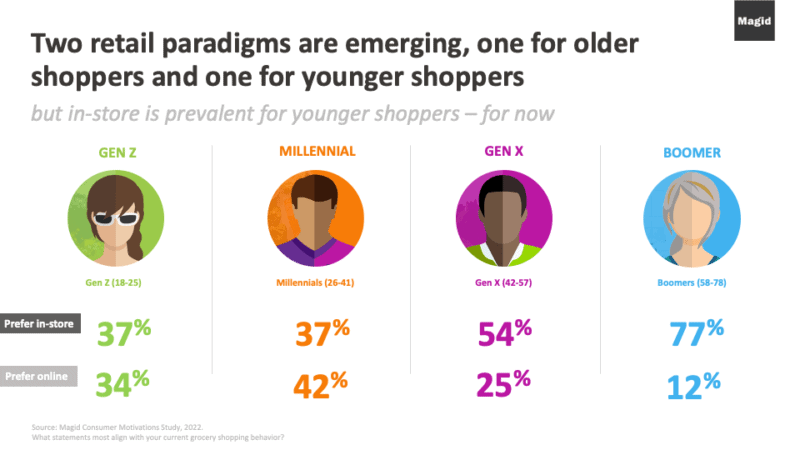

Those choices are definitely influenced by what generation the shopper falls into, as Magid’s Consumer Motivations Study suggests.

And Shopify reports that 81% of U.S. Gen Z consumers prefer to shop in store (generally) to discover new products, and more than 50% say in-store browsing is a way to disconnect from the digital world. While this tendency is more pronounced for hard goods such as apparel and electronics, it reinforces the point that shopping is a mixed bag and the broad range of experiences and opportunities in all channels needs to be understood and optimized.

But finding the right equation is very likely to pay off. According to McKinsey, the omnichannel shopper spends two to four times more than the in-store customer. Rightfully so, the focus has shifted from protecting in-store sales to supporting business both online and in stores through omnichannel excellence.

This is evidenced by Instacart’s recent announcement about their new suite of products designed to help grocers offer shoppers a “next-gen grocery ecosystem.” The company is debuting “Connected Stores,” a bundle of new and existing Instacart Platform technologies that will help grocers build a unified, seamless, personalized experience both online and in-store.

As shoppers utilize both online and offline options, success will be achieved by those who fully understand which shoppers are choosing which option, and under what circumstances. Importantly, it’s not exclusively that younger shoppers shop online, and older shoppers shop in physical stores – even if the general tendencies are in that direction.

Those astute marketers that meet specific needs of each cohort – such as product sampling or in-store cooking classes for inexperienced younger shoppers, or free delivery of online orders for older shoppers – will separate themselves from the pack and drive higher market share.

2. Prepare to pivot – frequently

External impacts need to be anticipated, even with the best of strategies. For example, Magid’s most recent wave of our bi-weekly AD.VANTAGE study showed shoppers reporting that higher gas prices have led them to use grocery delivery more so than they had previously. Despite the declining gas prices since June, current prices remain considerably higher than they were a year ago. But if higher gas prices drive higher delivery fees, this preference could shift.

CPG manufacturers and grocery retailers must be well informed in order to not only deliver what their shoppers need and want today, but, critically, to be well positioned to pivot as conditions quickly change or new challenges emerge – be it inflation, product or labor shortages, drastic weather, etc. – that shift consumers’ needs and wants, sometimes instantly.

- Set a social strategy

According to Shopify, “ecommerce activity is congregating on social media platforms, from brand marketing to customer service to shoppable advertising.”

Presently, this applies to non-grocery shopping, but one could easily imagine shifts in this direction for grocery products, at least for some brands and among specific shoppers – especially for certain family favorites, items that skew younger, or for particular usage occasions.

Capitalizing on this emerging channel will build loyalty for brands rather than products – which is often what occurs with ecommerce. Understanding it more fully for specific categories and brands will ensure that opportunities are not missed.

What the future holds

CPG manufacturers and grocery retailers know that they must be successful in optimizing the online shopping experience, but there is also a need to deliver great in-store experiences – which is still where most grocery shopping is done, and likely will be for the foreseeable future.

Questions grocery retailers and CPG manufacturers must address are:

– Which shoppers use which channels and under what circumstances?

– What are the drivers and barriers for each? Are these fixed or do they vary for some reason?

– For online shopping:

– Are there opportunities for enhancing the UX (user experience)? This includes search, impulse, communications, imagery and promotions.

– Is your product display page creating a brand experience or simply providing detailed information (and is even that aspect fully optimized?)?

– What type of fulfillment is preferred by different cohorts – especially those that are most strategically important to your business? What drives that preference, and is it subject to change (e.g., higher gas prices vs. delivery fees)?

– How can social commerce best be included in your distribution strategy – even if it is only a complementary aspect?

– Are there specific product strategies, such as new product trial or driving a particular promotion?

– Does it lend itself to celebrity endorsements or cross promotions/tie-ins?

The payoff may not be immediate, but these efforts will likely be rewarded with huge returns in the next calendar year.

Jonathan Asher is VP of Client Development in our Consumer and Commercial Brands practice, which serves clients in travel, retail, hospitality and consumer goods.