Video Entertainment Statistics 2019

Today, people are consuming a lot of video content. Whether it’s a funny cat compilation on YouTube or the latest news from their TV station of choice, people around the world are tuning in to video entertainment platforms more than ever before.

Despite this growth, the landscape of video entertainment is nearing a crossroads. Long gone are the days where TV providers had little to worry about in the way of competition—aside from others in the industry. In the last several years, streaming providers have surged.

Magid’s 2019 Video Entertainment Study (VES) has found that while Netflix and other streaming providers are catching up in overall popularity with linear TV, ad-based video on demand (AVOD) are best positioned for growth and represent the next major growth area for streaming.

Here are some key stats from the study illustrating this shift in demand for video content.

Live TV still leads, but its reign may soon be over

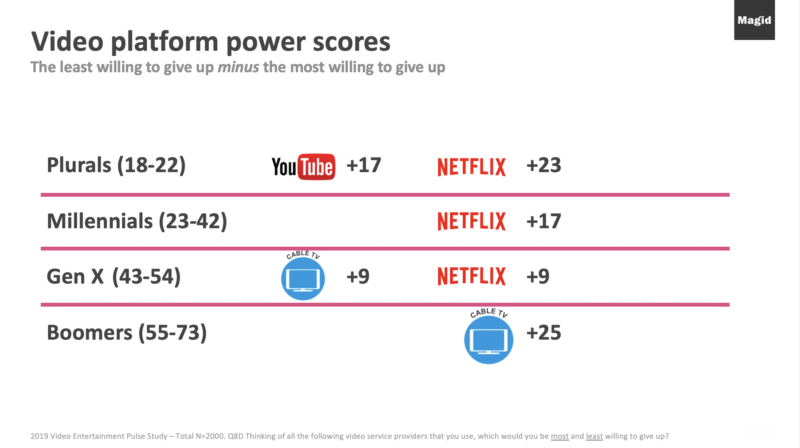

Live TV is surviving on the 55+-year-old demographic, as well as sports and news programming, which is best consumed live and in the moment (particularly in the age of ‘breaking news’).

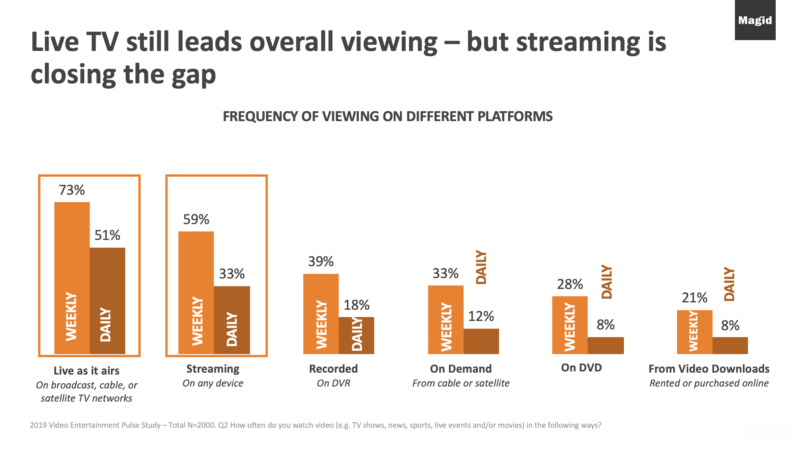

Overall, when asked how often they watch video in the following ways, 73% of respondents said they watch live TV weekly, while 51% said they watch live TV daily. Comparatively, 59% stream weekly, and 33% do so daily.

As it stands, live TV is still leading the pack, but the momentum is clearly on the side of streaming services.

For example, cord-cutting is on the rise. When pay TV subscribers were asked in 2013 how likely they were to cancel their TV service in the next 12 months, just 2.7% said they were.

However, that percentage has steadily risen, as nearly 9% said they were likely to cancel their TV service in 2019. As more consumers continue to cut ties with their TV service, the gap between weekly and daily live TV watchers and streamers will keep shrinking.

Slow and steady for the big three streaming services

Of the three top streaming providers (Netflix, Amazon Prime Video, and Hulu), Netflix reigns supreme with 54% of respondents saying that they, or someone in their household, pays for a subscription from the California-based company. This is relatively flat from 2018 when 58% of respondents answered “yes” to that same question.

Amazon Prime Video was also relatively flat in 2019, with 32% of respondents saying they or someone in their home pays for the service (35% in 2018). While smaller, Hulu has similarly been relatively flat-to-growing slightly – jumping to 27% in 2019 from 20% in 2017 and 24% in 2019.

HBO Now, YouTube Premium, and CBS Access are all vying for market share as well, and new additions like Apple TV and Disney+ will make the streaming wars all the more contentious in the next few years.

Ad-based Video on Demand on the rise

While advertisements and commercials are often considered a nuisance by many video content consumers, there is a growing interest in ad-based video-on-demand platforms.

In other words, video consumers are opting for trading a few moments of their time for free content as opposed to paying for it.

Back in 2018, 40% of respondents said they preferred watching video content like movies and TV shows on AVOD platforms. In 2019, that percentage jumped to 55%.

For comparison, 35% of those surveyed in 2019 said that subscription-based platforms without commercials were their preferred option, while 11% said they prefer paying for each video, program, or movie they watch without ads integrated into the content.

As we anticipated, more streaming providers have already identified ways to integrate AVOD features into their services, as its growing popularity is impossible to ignore.

“NBCU is a content powerhouse, and Peacock is a natural – even an inevitable – extension of the business,” said Magid’s Mike Bloxham when called upon by The Street to comment on the NBCU Peacock announcement last week.

“The free ad-supported model is not a surprise, and it leans heavily into what Magid’s research shows is a growing level of acceptance of ad-supported services among consumers.”