The future of Netflix – what’s really on the cards?

The extent to which Netflix has become a pop-culture staple and a constant in so many people’s lives – it was reported back in January that the streaming service has 139 million subscribers globally – is nothing short of extraordinary.

It has continued to build on its success, tweaking and shifting at an explosive rate to stay ahead of the competition, of which there is more than ever before.

The streaming platform is bringing in a number of changes and hinting at adjustments we could possibly see to ensure that it remains at the forefront. Here are just some of those changes, both guaranteed and potential, and how they will affect the platform.

More original and global content

The tectonic plates are in serious motion over at Netflix as the company strives to focus on more in-house projects rather than acquisitions from other networks.

“We spent $8 billion last year to create original content,” Andy Law, director of product design, told The Economic Times.

And while Netflix has produced many duds, the likes of Sex Education, The Crown and Stranger Things more than make up for it, with those payouts truly paying off.

Netflix is also branching out to deliver a raft of titles whose roots lie outside the UK and US, with more funds being channelled into into non-English speaking projects such as Dark (Germany), 3% (Brazil) and Delhi Crime (India).

Netflix representative Kim Minyoung added: “We want to create content that can be intuitionally understood by the global audience, beyond language barriers.

“Netflix’s content crosses borders, showing our positive side.”

The mass Marvel clear-out that happened recently – Daredevil, Luke Cage, Iron Fistand Jessica Jones were all cancelled – was one of the biggest indicators that the tide is turning.

When Netflix was a relative unknown, brands like Marvel helped boost it, offering it clout, but Netflix has become its own entity and the brand is now robust enough to stand on its own two feet, hence the kicking those shows to the curb.

Lots of brand new shows are coming.

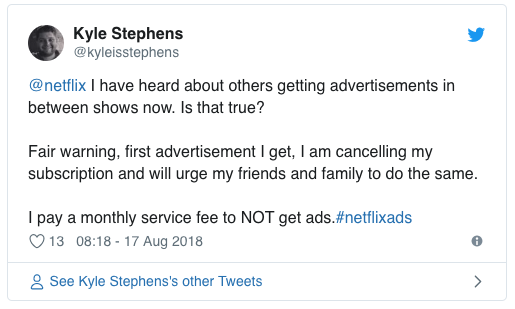

Adverts

There was a mixture 0f panic and anger among some Netflix users last year when one Redditor claimed that an advert had popped up while they were watching a show.

“If you could think of a way to degrade my experience further, I’m not sure what it would be. Completely disrupted my enjoyment of the show I was watching,” said zgrizz.

“With the obnoxious autoplay while browsing, and now this, you are rapidly moving into 3rd place behind Amazon and Hulu in our household.

“Making yourself less interesting than your competition is NOT smart business. No suggestions here. Just observations. Don’t really care what the carebears at Netflix think.

“They need my money, I don’t need their ads.”

Word quickly began to spread, forcing Netflix to pipe up and address the situation.