New Stores, Brands Win Converts During Pandemic

With many shoppers having changed their usual shopping habits amid the coronavirus, there were bound to be food retailers winning over new shoppers, and now we know which are doing the best job at it. According to New York-based research consultancy Magid, new shoppers had the best experience at Sam’s Club (61%), Meijer (54%) and Costco (49%), with consumers rating their experiences at these companies’ stores as much/somewhat better than their previous preferred retailers.

“With comparable experiences, consumers are likely to continue shopping at replacement retailers, with select retailers positioned to capitalize,” Magid noted in its two-stage study, “COVID-19 and Impact of on the Food and Beverage Industry,” that consumers chose Albertsons (89%), Sam’s Club (82%) and Trader Joe’s (79%) as the stores they were most likely to continue going to.

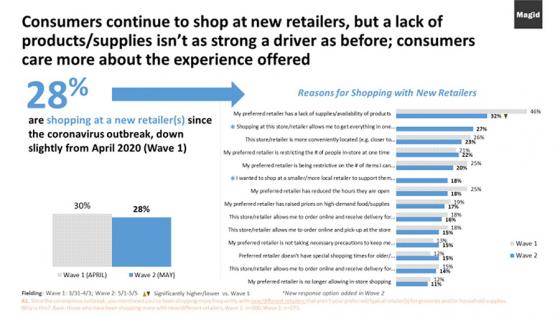

As to why consumers were shopping at different retailers, Magid observed that “a lack of products/supplies isn’t as strong a driver as before; consumers care more about the experience offered.” Indeed, from the first wave of the study, in early April, this motivation had declined from 46% to 32%. Reasons given by shoppers for shopping elsewhere included one-stop shopping (27%), convenient location (23%) and lower prices (17%).

Magid also found that 78% of consumers who’ve tried new brands are continuing to buy them even as once-preferred products become available.

Shoppers are likely to continue buying new brands in the future across all categories, as 67% of those surveyed by the consultancy said that their experience with the new items is better or the same as their former favorite products and brands. The categories most vulnerable to permanent brand switching are coffee (85%), eggs (84%), dry goods (82%), snack bars (82%) and pasta (79%).

These changes are also prevalent with private label brands, as 60% of consumers are likely to keep buying new private label brands after the coronavirus pandemic ends. The categories in which they’re likely to continue purchasing private label items are baby food (80%), snack bars (78%), spices (76%), dry goods (74%) and vitamins (74%).

Despite the fact that many states are starting to loosen restrictions, when asked when life will get back to normal, 14% of consumers said that they expected the return to take more than a year, up 10% from the first iteration of the study.

Of particular concern to food retailers, just one in five consumers said that they completely trust grocers to take the necessary steps to ensure their health and safety, which may spur such companies to better promote their efforts in this regard.

View the original article on Progressive Grocer.